In an more and more interconnected global economic climate, organizations working in the Middle East and Africa (MEA) confront a diverse spectrum of credit history threats—from unstable commodity charges to evolving regulatory landscapes. For fiscal institutions and company treasuries alike, robust credit rating chance administration is not simply an operational requirement; This is a strategic differentiator. By harnessing accurate, timely data, your world possibility administration team can renovate uncertainty into possibility, making sure the resilient development of the businesses you aid.

one. Navigate Regional Complexities with Self esteem

The MEA location is characterised by its financial heterogeneity: oil-pushed Gulf economies, useful resource-wealthy frontier markets, and speedily urbanizing hubs throughout North and Sub-Saharan Africa. Each and every current market offers its own credit profile, authorized framework, and forex dynamics. Data-pushed credit rating possibility platforms consolidate and normalize info—from sovereign scores and macroeconomic indicators to individual borrower financials—enabling you to definitely:

Benchmark possibility across jurisdictions with standardized scoring versions

Recognize early warning signals by monitoring shifts in commodity charges, FX volatility, or political hazard indices

Greatly enhance transparency in cross-border lending selections

2. Make Educated Choices via Predictive Analytics

As opposed to reacting to adverse events, main institutions are leveraging predictive analytics to anticipate borrower anxiety. By making use of machine Understanding algorithms to historical and real-time facts, you'll be able to:

Forecast chance of default (PD) for company and sovereign borrowers

Estimate publicity at default (EAD) under diverse economic situations

Simulate reduction-specified-default (LGD) utilizing recovery charges from previous defaults in very similar sectors

These insights empower your workforce to proactively adjust credit limits, pricing methods, and collateral necessities—driving superior chance-reward outcomes.

3. Improve Portfolio Overall performance and Capital Performance

Correct info permits granular segmentation of your respective credit score portfolio by business, location, and borrower measurement. This segmentation supports:

Threat-altered pricing: Tailor curiosity rates and charges to the precise chance profile of each and every counterparty

Concentration monitoring: Restrict overexposure to any single sector (e.g., Power, development) or country

Funds allocation: Deploy financial cash a lot more competently, lowering the price of regulatory money underneath Basel III/IV frameworks

By continuously rebalancing your portfolio with data-driven insights, it is possible to improve return on threat-weighted assets (RORWA) and unencumber money for expansion alternatives.

four. Improve Compliance and Regulatory Reporting

Regulators over the MEA area are progressively aligned with world wide benchmarks—demanding demanding pressure testing, scenario Assessment, and transparent reporting. A centralized information System:

Automates regulatory workflows, from info collection to report era

Guarantees auditability, with complete details lineage and change-administration controls

Facilitates peer benchmarking, evaluating your institution’s metrics versus regional averages

This lowers the potential risk of non-compliance penalties and enhances your standing with equally regulators and buyers.

five. Increase Collaboration Throughout Your International Possibility Team

By using a unified, data-driven credit chance management process, stakeholders—from entrance-Workplace romantic relationship supervisors to credit history committees and senior executives—gain:

Genuine-time visibility into evolving credit score exposures

Collaborative dashboards that highlight portfolio concentrations and tension-check final results

Workflow integration with other chance functions (marketplace danger, liquidity danger) to get a holistic organization possibility watch

This shared “single supply Credit Risk Management of fact” eliminates silos, accelerates decision-earning, and fosters accountability at each individual degree.

six. Mitigate Rising and ESG-Relevant Dangers

Further than classic monetary metrics, fashionable credit score possibility frameworks incorporate environmental, social, and governance (ESG) aspects—vital within a area where by sustainability initiatives are gaining momentum. Information-driven equipment can:

Score borrowers on carbon intensity and social effect

Design changeover pitfalls for industries exposed to shifting regulatory or consumer pressures

Aid green funding by quantifying eligibility for sustainability-linked loans

By embedding ESG knowledge into credit score assessments, you not only potential-evidence your portfolio but also align with world-wide Trader anticipations.

Conclusion

From the dynamic landscapes of the Middle East and Africa, mastering credit rating threat management requires in excess of instinct—it calls for arduous, information-pushed methodologies. By leveraging accurate, comprehensive facts and Innovative analytics, your worldwide hazard administration team could make perfectly-educated choices, enhance money usage, and navigate regional complexities with confidence. Embrace this solution right now, and completely transform credit threat from a hurdle into a aggressive gain.

Ariana Richards Then & Now!

Ariana Richards Then & Now! Karyn Parsons Then & Now!

Karyn Parsons Then & Now! Raquel Welch Then & Now!

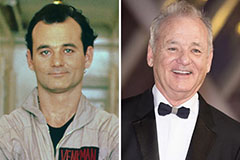

Raquel Welch Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now! Nicki Minaj Then & Now!

Nicki Minaj Then & Now!